The prevailing wisdom is that an unregulated free

market is essential to economic growth and ultimately will produce the most good for society. If everyone acts in

his own self-interest, things will get progressively better for all. This

is what Adam Smith called the “invisible hand of the marketplace”.

Contrast this to the centrally controlled economy of the former Soviet

Union, and the free market argument seems irrefutable. Every social

problem has a superior market solution.

What’s not generally advertised is that Adam Smith

opposed and even hated the very idea of corporations. He saw them as a

cancer that would overtake and pervert the marketplace. They have.

A case in point is unfolding in Texas. In the

deregulated electric utility market there, a provider has raised the

electric rates of “high risk” subscribers. In some cases, it has

raised the rates of consumers who have never been late paying their

electric bill. Some people have had their rates raised, get this, because

they have been late paying their cable bill!

Apparently, in Texas there is an index based on

pooled data of customer payments for all utilities, including electric,

gas, cable, etc. If you’re late on one of them, any and all of the

others can boost your rate for their service.

As of November 2004, only this one electric

utility has boosted it’s customers’ rates based on the index, and they

hid their reason for doing so behind the excuse of rising energy costs.

The case is being challenged, but all the rest of the utility providers

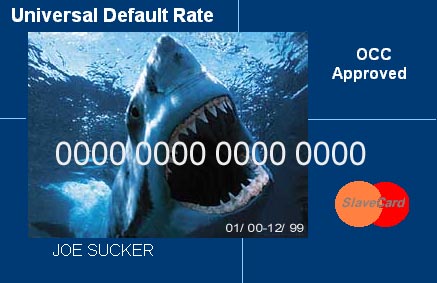

are circling like sharks to see what happens. If the case is found in the

company’s favor, the rest will join in the feeding frenzy.

The company’s rationale given in a public statement

is that deadbeats cost other consumers unfairly, and that they are simply

applying a “market-based solution” to the problem. Of course, this is

hogwash. They’re just trying to make more money, but even if you accept

their claim, the mechanism employed is pernicious to the wealth and

well being of a whole class of society, the working poor.

Think of a single mother struggling to make ends

meet. In a month when there is a shortfall, she may let the cable bill

slide so she can buy groceries. Very often, we all find ourselves in a

bind, especially when there have been unforeseen kids’ medical

emergencies.

This woman prioritizes and chooses to pay bills for

the necessities like gas and electric, but next month she will be further

burdened by having to pay more for the same amount of electricity used,

and soon may get hammered on all fronts. Thus, here plight is made worse,

not better, by this wondrous market solution.

This is happening to millions of people now with

their credit cards. Miss one payment on a single card, even accidentally,

and all your rates can rise; all that's required by law is a fifteen day

notice from the card issuer. If your financial situation isn’t

precarious, this is a mere irritation, a small setback. But many people

are living on the edge, not just the working poor either. This kind of

market solution can push them off into a free-fall.

The seriousness of the problem is verified by the

fact the major area of profit growth for lending

institutions is now in levying fees, not in charging interest. This

isn’t the invisible hand of the market place, it’s the maw of the

corporate loan shark.

You may not care, because you may be in good financial shape and can’t imagine it happening to you. Perhaps the lenders and the utilities will actually decide to pass some of the savings on to you. But don’t tell me that single mother is going to benefit. She like so many others is headed for the bottom. And if you lack empathy, at least remember this: most bankruptcies result from staggering medical bills, not from profligacy. What goes around comes around. Keep a lookout for fins.